Retirement Plan Sponsors

The need for professional retirement plan and investment advice - from an advisor you can trust - has never been greater.

As an employer, you share the responsibility for guiding your employees toward making decisions that will afford them greater financial freedom in retirement. But here’s the quandary: Just as your employees look to you for financial guidance and advice, you must seek out an expert to help you navigate plan regulation and administration.

With the retirement industry becoming more complex and regulated, today’s plan sponsors need more specialized services, including:

- Fiduciary and consulting support to help manage fiduciary requirements and risk

- Professional advice about how to offer competitive employee benefits at a reasonable cost

- Access to robust data to use in benchmarking plans and investment managers

- More effective financial education programs for employees

Like most plan sponsors, you have many demanding challenges competing for your attention. Because we work with retirement plans every day, our experience can help save you time, effort and worry. We’re confident that our service capabilities will allow us to deliver value, seek to improve participant outcomes, and help you manage your fiduciary risks.

Resources for Retirement Plan Sponsors

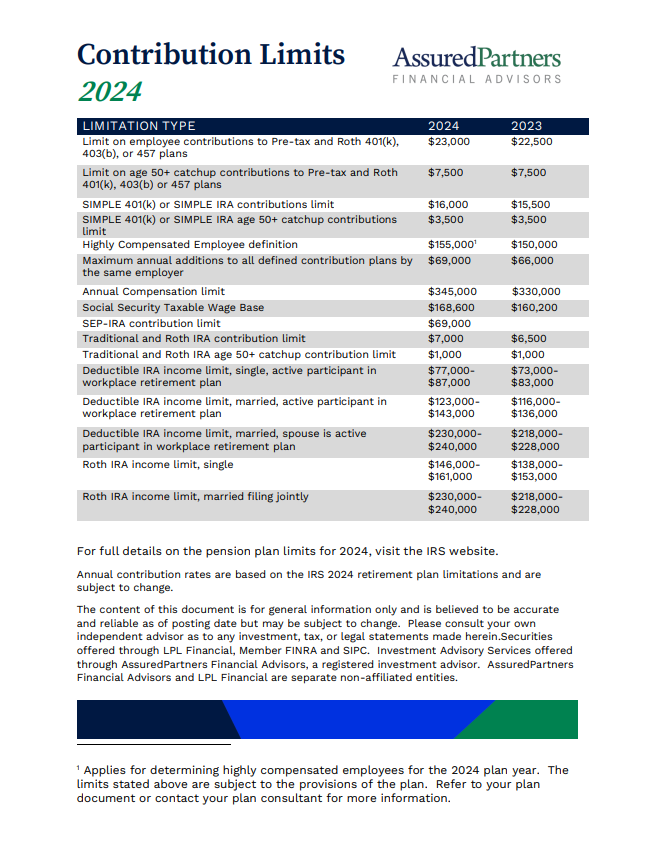

Annual Contribution Limits, Plan Comparison

Whether you’re an employer who wants to help your employees work toward a secure retirement, or someone who wants to plan for your own future, this handy guide can help you narrow the focus and zero in on a retirement plan that could work for you in 2024. Because of the complexities involved with qualified

retirement plans, always consult your legal or tax advisor to be sure you are complying with the rules.

Taking Charge of Your Fiduciary Responsibilities

By sponsoring a 401(k) plan, you’ve made an important investment in helping secure the future of your company’s most valuable asset—your employees. This guide is designed to help you understand these responsibilities and how to effectively manage the retirement plan you offer your employees.

Inside This Guide You’ll Find:

- What is a fiduciary

- What are the basic fiduciary responsibilities

- How ERISA Section 404(c) can help limit your liability

- The importance of documentation

- Why you need an Investment Policy Statement

- How to approach the investment selection and monitoring process

- What you need to communicate to participants

- Your plan administration responsibilities

Iowa

4200 University Avenue, Suite 200

West Des Moines, IA 50266

800-677-1529

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advisory services offered through Global Retirement Partners, LLC dba AssuredPartners Financial Advisors, an SEC registered investment advisor. AssuredPartners Financial Advisors and LPL Financial are separate non-affiliated entities.

GRP Advisor Alliance is an independent network of retirement plan focused advisors. GRP Advisor Alliance is not affiliated with or endorsed by LPL Financial.

The financial professionals associated with LPL Financial may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.